How Top Buy A House With No Money Down

How to buy a house with no money

A no down payment mortgage allows first-time home buyers and echo domicile buyers to buy belongings with no coin required at endmost, except standard endmost costs.

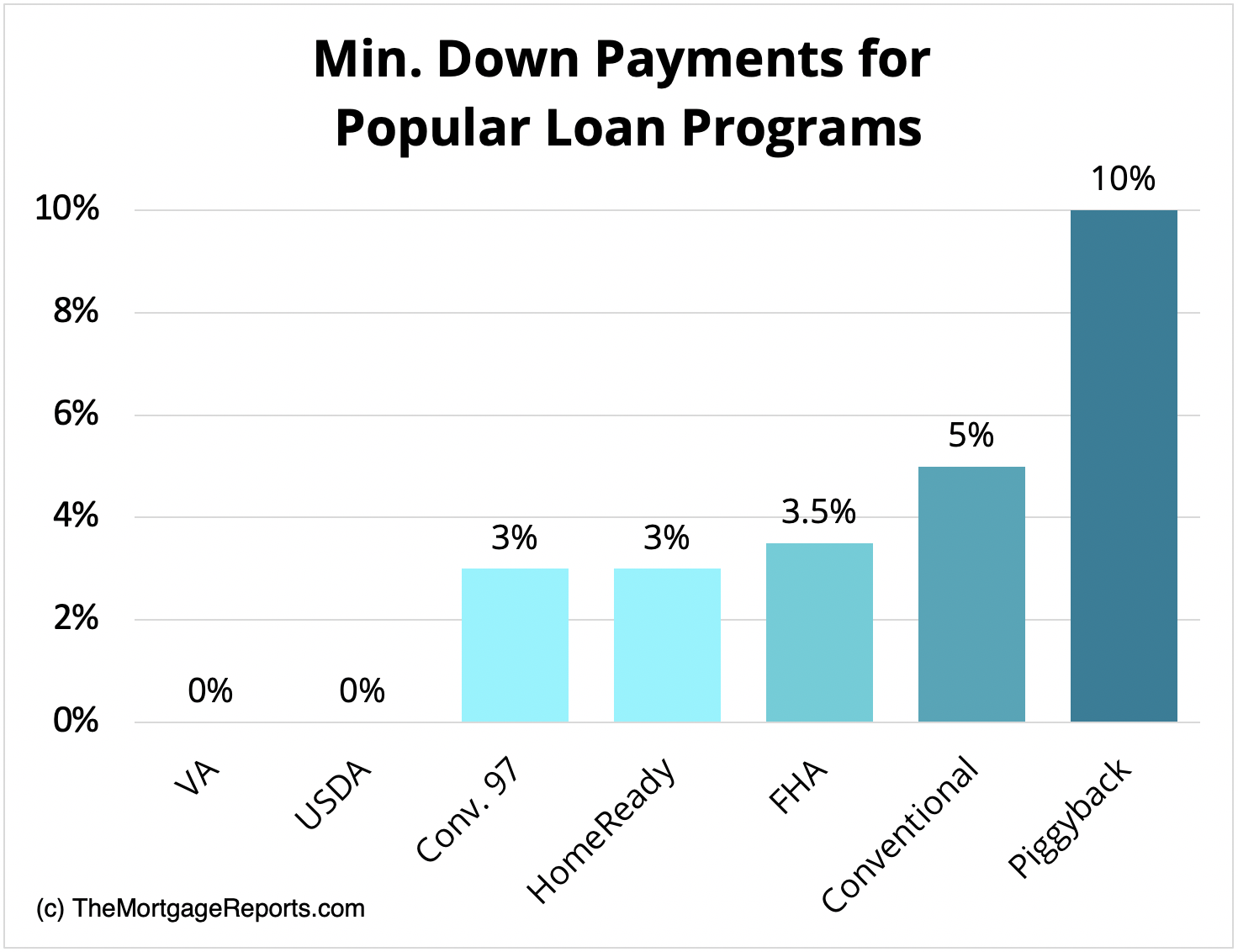

Other options, including the FHA loan, the HomeReady mortgage, and the Conventional 97 loan, offer low down payment options starting at 3% down. Mortgage insurance premiums typically back-trail low and no downwardly payment mortgages, but not always.

Thanks to these programs, home buyers no longer take to save for years to buy a home. Many are fix to purchase and simply don't know it yet.

In this article (Skip to...)

- Buying with no money

- USDA loans (0% down)

- VA loans (0% downwards)

- FHA loans (3.5% downwardly)

- HomeReady loan (3% downwards)

- Conventional 97 (3% down)

- Conventional (five% down)

- Piggyback Loan (10% downwardly)

- Should yous put 20% down?

- Down payment FAQ

Tin can you lot buy a house with no money down?

If you desire to buy a house with no money, in that location are two large expenses you'll need to avert: the downwardly payment and closing costs. This may be possible if you authorize for a cipher-down mortgage and/or a abode buyer assistance programme.

Five strategies to buy a house with no coin include:

- Utilise for a zip-downwards VA loan or USDA loan

- Use down payment assistance to cover the downwards payment

- Ask for a downwards payment souvenir from a family member

- Go the lender to pay your closing costs ("lender credits")

- Get the seller to pay your endmost costs ("seller concessions")

When combined, these tactics could put you in a new home with $0 out of pocket.

Or you might get your down payment covered, then you'd only need to pay closing costs out of pocket — which could reduce your cash requirement by thousands.

First-fourth dimension domicile buyer loans with aught down

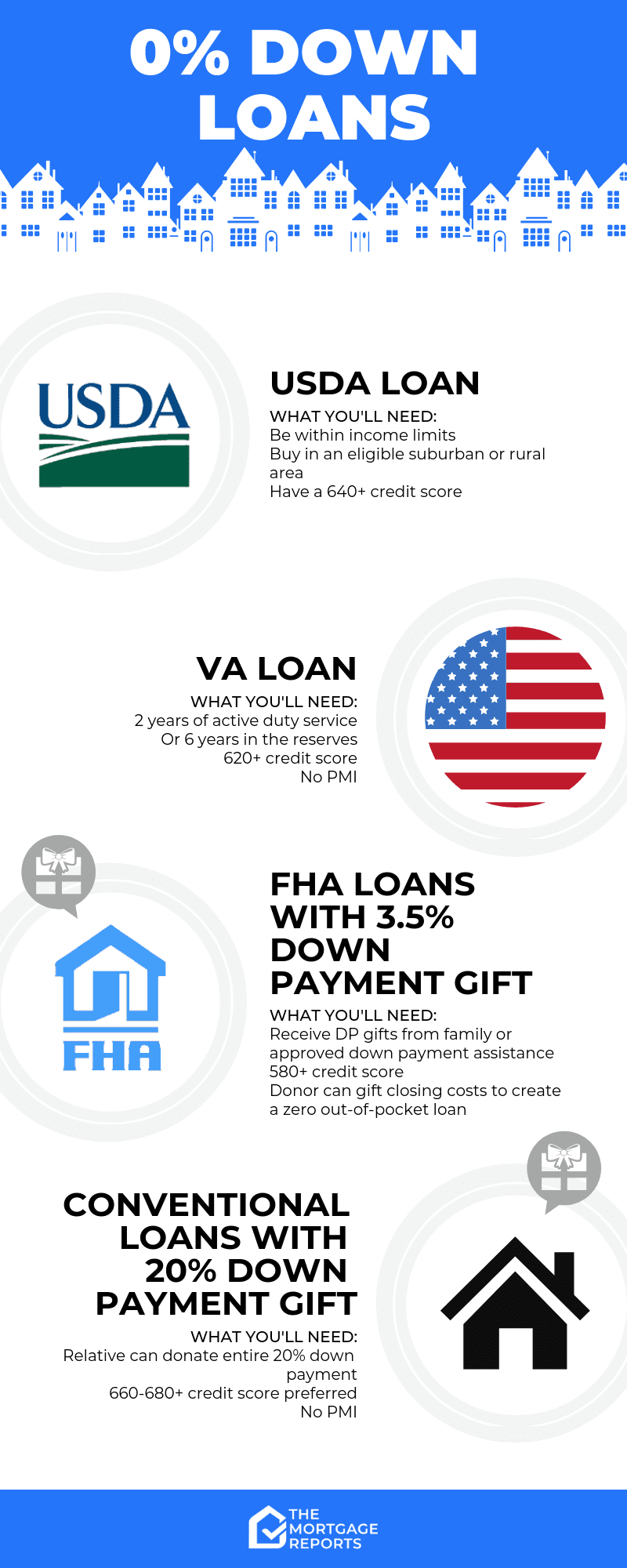

There are but ii major loan programs with aught down: the USDA loan and the VA loan. Both are available to starting time-time dwelling buyers and echo buyers akin. Simply they accept special eligibility requirements to qualify.

No down payment: USDA loans (100% financing)

The U.S. Department of Agriculture offers a 100% financing mortgage. The program is known as the 'Rural Housing Loan' or merely 'USDA loan.'

The skilful news about the USDA Rural Housing Loan is that it's non just a "rural loan" — it's bachelor to buyers in suburban neighborhoods, too. The USDA'due south goal is to help "low-to-moderate income homebuyers" across most of the U.S., excluding major cities.

Many borrowers using the USDA loan program brand a adept living and reside in neighborhoods that don't meet the traditional definition of a 'rural surface area.'

Some key benefits of the USDA loan are:

- No down payment requirement

- No maximum habitation purchase price

- Below-market involvement rates

- The upfront guarantee fee can be added to the loan remainder at closing

- Monthly mortgage insurance fees are cheaper than for FHA

Just be aware that USDA enforces income limits; your household income must be almost or below the median for your area.

Another primal benefit is that USDA mortgage rates are ofttimes lower than rates for comparable depression- or no- downwardly-payment mortgages. Financing a home via USDA can be the lowest-cost path to homeownership.

No down payment: VA loans (100% financing)

The VA loan is a no-downwardly-payment mortgage bachelor to members of the U.South. military, veterans, and surviving spouses.

VA loans are backed by the U.Due south. Department of Veterans Diplomacy. That means they have lower rates and easier requirements for borrowers who meet VA mortgage guidelines.

VA loan qualifications are straightforward.

Most veterans, active-duty service members, and honorably discharged service personnel are eligible for the VA program. In addition, home buyers who take spent at least 6 years in the Reserves or National Guard are eligible, as are spouses of service members killed in the line of duty.

Some key benefits of the VA loan are:

- No down payment requirement

- Flexible credit score minimums

- Below-market mortgage rates

- Defalcation and other derogatory credit information does not immediately disqualify you

- No mortgage insurance is required, only a erstwhile funding fee which can be included in the loan amount

In addition, VA loans take no maximum loan corporeality. Information technology's possible to become a VA loan above current conforming loan limits, as long every bit yous have strong enough credit and you can beget the payments.

Low downward payment showtime-time home buyer loans

Non everyone will authorize for a zero-down mortgage. But it may withal be possible to buy a house with no money downwardly by choosing a low-downwardly-payment mortgage and using an help program to cover your upfront costs.

If you want to go this route, here are a few of the best low-money-down mortgages to consider.

Depression down payment: FHA loans (3.v% down)

The 'FHA mortgage' is a bit of a misnomer because the Federal Housing Administration (FHA) doesn't actually lend money.

Rather, the FHA sets basic lending requirements and insures these loans in one case they're made. The loans themselves are offered by nigh all private mortgage lenders.

FHA mortgage guidelines are famous for their liberal approach to credit scores and downwards payments.

The FHA will typically insure dwelling loans for borrowers with low credit scores, so long as there's a reasonable explanation for the depression FICO.

FHA also allows a down payment of just 3.five% in all U.S. markets, with the exception of a few FHA approved condos.

Other benefits of an FHA loan are:

- Your down payment may come entirely from souvenir funds or down payment assistance

- The minimum credit score is 500 with a 10% down payment, or 580 with a iii.5% downwardly payment

- Upfront mortgage insurance premiums can be included in the loan corporeality

Furthermore, the FHA tin can sometimes help homeowners who take experienced recent short sales, foreclosures, or bankruptcies.

The FHA insures loan sizes up to $ in designated "loftier-cost" areas nationwide. Loftier-cost areas include places like Orangish County, California; the Washington D.C. metro area; and, New York Metropolis'due south 5 boroughs.

Note that if you want to use an FHA loan, the home being purchased must be your primary residence. This program isn't intended for vacation homes or investment properties.

Low down payment: HomeReady/Dwelling Possible (3% down)

The HomeReady mortgage is special among today's low- and no-down-payment mortgages.

Backed by Fannie Mae and available from nearly every U.S. lender, the HomeReady mortgage offers below-market place mortgage rates, reduced private mortgage insurance (PMI) costs, and innovative underwriting for lower-income dwelling buyers.

For case, the HomeReady programme lets you use boarder income to help qualify, and yous tin employ income from a not-zoned rental unit of measurement, as well — even if you're paid in cash.

HomeReady home loans were designed to help multi-generational households get approved for mortgage financing. However, the program can be used by anyone in a qualifying area, or who meets household income requirements.

Freddie Mac offers a similar program, called Home Possible, which is also worth a look.

Domicile Possible is a picayune less flexible most income qualification than HomeReady. But it offers many similar benefits, including a minimum 3% downwardly payment.

Depression downwards payment: Conventional loan 97 (3% down)

The Conventional 97 program is bachelor from Fannie Mae and Freddie Mac. It's a 3% down payment program and, for many home buyers, it's a less expensive loan option than an FHA mortgage.

Basic qualification requirements for a Conventional 97 loan include:

- Loan size may non exceed $, even if the dwelling house is in a high-cost market

- The belongings must be a single-unit dwelling. No multi-unit homes are immune

- The mortgage must exist a stock-still-rate mortgage. No adjustable-rate mortgages are allowed via the Conventional 97

The Conventional 97 program does not enforce a specific minimum credit score across those for a typical conventional home loan. The program tin can exist used to refinance a home loan, too.

In addition, the Conventional 97 mortgage allows for the entire 3% down payment to come up from gifted funds, and then long as the gifter is related by blood or marriage, legal guardianship, domestic partnership, or is a fiance/fiancee.

Low down payment: Conventional mortgage (five% down)

Conventional 97 loans are a little more restrictive than 'standard' conventional loans, considering they're intended for starting time-time habitation buyers who demand actress help qualifying.

If you don't meet the guidelines for a Conventional 97 loan, you can salvage up a little more and try for a standard conventional mortgage.

Conventional mortgages are the near popular loan type in the market considering they're incredibly flexible. You can make a down payment as low as 5% or as big as 20% or more. And you only need a 620 credit score to authorize in many cases.

Plus, conventional loan limits are higher than FHA loan limits. So if your buy price exceeds FHA'south limit, you lot might want to salvage upwards 5% and try for a conventional loan instead.

Conventional mortgages with less than 20% down require individual mortgage insurance (PMI). But this can exist canceled once you accept 20 pct equity in the abode. And then you lot're non stuck with the additional fee forever.

Low down payment: The "Piggyback Loan" (10% down)

One final selection if you lot desire to put less than 20% down on a house — but don't want to pay mortgage insurance — is a piggyback loan.

The "piggyback loan" or "80/10/x" program is typically reserved for buyers with above-average credit scores. It's actually twoloans, meant to give habitation buyers added flexibility and lower overall payments.

The beauty of the lxxx/10/10 is its structure.

- With an 80/x/10 loan, buyers bring a ten% downward payment to endmost

- They also get a ten% second mortgage (HEL or HELOC)

- This leaves an 80% mortgage loan

- Since you're effectively putting 20% down, in that location is no PMI

The first mortgage is typically a conventional loan via Fannie Mae or Freddie Mac, and it's offered at current market mortgage rates.

The second mortgage is a loan for 10% of the habitation's buy price. This loan is typically a abode equity loan (HEL) or home equity line of credit (HELOC).

And that leaves the concluding "10," which represents the buyer's down payment amount — ten% of the purchase price. This amount is paid as cash at closing.

This type of loan structure can help y'all avoid private mortgage insurance, lower your monthly mortgage payments, or avoid a colossal loan if you're right on the cusp of conforming loan limits.

However, y'all'll typically need a credit score of 680-700 or higher to qualify for the second mortgage. And you'll take 2 monthly payments instead of one.

If you lot're interested in a piggyback mortgage, hash out pricing and eligibility with a lender. Make sure you lot're getting the most affordable dwelling loan overall — month-to-month and in the long term.

Dwelling house buyers don't need to put xx% down

Information technology'south a common misconception that "20 percent down" is required to purchase a habitation. And, while that may have truthful at some indicate in history, it hasn't been then since the appearance of the FHA loan in 1934.

In today's real estate market place, dwelling buyers don't need to make a 20% down payment. Many believe that they practise, however — despite the obvious risks.

The likely reason buyers believe 20% down is required is considering, without xx percent, you'll have to pay for mortgage insurance. Only that'south non necessarily a bad thing.

PMI is not evil

Private mortgage insurance (PMI) is neither good nor bad, simply many home buyers even so effort to avoid it at all costs.

The purpose of individual mortgage insurance is to protect the lender in the issue of foreclosure — that'southward all information technology's for. However, because it costs homeowners coin, PMI gets a bad rap.

It shouldn't.

Considering of private mortgage insurance, home buyers can get mortgage-approved with less than 20% down. And, eventually, private mortgage insurance can be removed.

At the rate today's home values are increasing, a heir-apparent putting iii% down might pay PMI for fewer than four years.

That's non long at all. Yet many buyers — especially first-timers — will put off a purchase because they desire to save upward twenty percentage.

Meanwhile, home values are climbing.

For today'southward dwelling buyers, the size of the down payment shouldn't be the just consideration.

This is because home affordability is not near the size of your downward payment — it's about whether you can manage the monthly payments and still have cash left over for "life."

A big down payment will lower your loan corporeality, and therefore will give you a smaller monthly mortgage payment. However, if you've depleted your life savings in order to make that large downwardly payment, you've put yourself at risk.

Don't deplete your unabridged savings

When the bulk of your money is tied up in a dwelling, fiscal experts refer to it as existence "house-poor."

When you're business firm-poor, y'all have plenty of coin on paper but little cash available for everyday living expenses and emergencies.

And, as every homeowner will tell you, emergencies happen.

Roofs collapse, water heaters break, yous become ill and cannot work. Insurance tin help you with these issues sometimes, but non always.

That's why existence house-poor is so dangerous.

Many people believe it's financially conservative to put twenty% downwards on a home. If 20% is all the savings you have, though, using the full amount for a downwardly payment is the opposite of beingness financially bourgeois.

The truthful financially conservative option is to make a pocket-size downward payment and leave yourself with some coin in the bank. Beingness firm-poor is no way to live.

Mortgage downwards payment FAQ

Here are answers to some of the near frequently asked questions about mortgage down payments.

What is the minimum downward payment for a mortgage?

The minimum down payment varies by mortgage program. VA and USDA loans allow zero down payment. Conventional loans outset at three percent down. And FHA loans crave at least 3.5 percent downwards. Y'all are gratis to contribute more than than the minimum down payment corporeality if you desire.

Are in that location zero-down mortgage loans?

There are only ii showtime-fourth dimension domicile buyer loans with zero downwards. These are the VA loan (backed by the U.S. Department of Veterans Diplomacy) and the USDA loan (backed past the U.S. Department of Agriculture). Eligible borrowers tin purchase a house with no money down but volition still have to pay for closing costs.

How can I buy a firm with no money down?

In that location are ii ways to buy a house with no money down. One is to get a nil-down USDA or VA mortgage if you qualify. The other is to get a depression-down-payment mortgage and encompass your upfront cost using a down payment assist program. FHA and conventional loans are available with merely 3 or 3.5 per centum down, and that entire amount could come from downwards payment assistance or a cash gift.

What credit score do I demand to purchase a house with no money down?

The no-money-down USDA loan program typically requires a credit score of at least 640. Some other no-money-downward mortgage, the VA loan, allows credit scores equally low equally 580-620. Merely you must be a veteran or service fellow member to qualify.

What are down payment assist programs?

Down payment aid programs are available to abode buyers nationwide, and many get-go-time home buyers are eligible. DPA tin come in the grade of a home heir-apparent grant or a loan that covers your down payment and/or closing costs. Programs vary by state, so exist sure to enquire your mortgage lender which programs yous may be eligible for.

Are there any dwelling heir-apparent grants?

Home buyer grants are offered in every state, and all U.S. abode buyers tin can utilize. These are also known equally downwardly payment assist (DPA) programs. DPA programs are widely available simply seldom used — many home buyers don't know they be. Eligibility requirements typically include having low income and a decent credit score. Simply guidelines vary a lot by program.

Tin can cash gifts be used every bit a down payment?

Yes, cash gifts can exist used for a down payment on a domicile. But you must follow your lender'southward procedures when receiving a cash gift. First, brand sure the souvenir is made using a personal cheque, a cashier's bank check, or a wire. Second, continue paper records of the gift, including photocopies of the checks and of your deposit to the bank. And make sure your deposit matches the amount of the gift exactly. Your lender will also want to verify that the gift is actually a gift and non a loan in disguise. Greenbacks gifts must not require repayment.

What are FHA loan requirements?

FHA loans typically require a credit score of 580 or higher and a 3.5 percent minimum down payment. You lot will also need a stable income and two-year employment history verified by W-2 statements and paystubs, or by federal tax returns if self-employed. The home yous're purchasing must exist a primary residence with 1-four units that passes an FHA dwelling appraisal. And your loan amount cannot exceed local FHA loan limits. Finally, you cannot accept a recent bankruptcy, foreclosure, or curt sale.

What are the benefits of putting more money down?

Just every bit there are benefits to low- and no-coin-down mortgages, there are benefits to putting more than money downward on a home purchase. For example, more than money down means a smaller loan amount — which reduces your monthly mortgage payment. Additionally, if your loan requires mortgage insurance, with more money down, your mortgage insurance will be removed in fewer years.

If I make a low downward payment, do I pay mortgage insurance?

Mortgage insurance is typically required with less than 20 percent downwards, just non always. For example, the VA Home Loan Guaranty plan doesn't require mortgage insurance, so making a depression downwardly payment won't matter. Conversely, FHA and USDA loans e'errequire mortgage insurance. And so fifty-fifty with large down payments, y'all'll have a monthly MI charge. The only loan for which your downward payment corporeality affects your mortgage insurance is the conventional mortgage. The smaller your down payment, the higher your monthly PMI. However, one time your dwelling house has 20 percentage equity, you'll be eligible to take your PMI removed.

If I make a low down payment, what are my lender fees?

Lender fees are typically determined as a percentage of your loan amount. For instance, the loan origination fee might exist one per centum of your mortgage rest. The bigger your downward payment, the lower your loan amount will be. So putting more than money downwardly tin can assist lower your lender fees. But you'll nevertheless have to bring more cash to the closing table in the form of a down payment.

How can I fund a down payment?

Some of the more common ways to fund a downward payment are to utilise your savings or checking account, or, for repeat buyers, the proceeds from the sale of your existing dwelling house. Other ways to fund a down payment include using a cash souvenir or borrowing from a 401k or IRA (although that'south generally non recommended). Downwardly payment assistance programs can fund a down payment, besides. DPAs lend or grant money to abode buyers with the stipulation that they live in the home for a certain number of years — often v years or longer.

How much habitation can I afford?

The answer to the question 'How much dwelling house tin can I beget?' is a personal 1 and should non exist left solely to your mortgage lender. The best mode to decide how much house you can beget is to starting time with your monthly upkeep and decide what you can comfortably pay for a domicile each month. Then, using your desired payment as the starting point, use a mortgage estimator and piece of work astern to find your maximum home purchase price.

What are today'south depression-downward-payment mortgage rates?

Mortgage rates accept risen from their all-time lows. But the good news is, many low-down-payment mortgages have below-market rates thanks to their authorities bankroll; these include FHA loans (3.five% down) and VA and USDA loans (0% downwardly).

Different lenders offer different rates, so you'll want to compare a few mortgage offers to find the best deal on your low- or no-down-payment mortgage. You can get started right here.

The data contained on The Mortgage Reports website is for advisory purposes merely and is not an advert for products offered past Full Beaker. The views and opinions expressed herein are those of the writer and exercise not reflect the policy or position of Full Chalice, its officers, parent, or affiliates.

Source: https://themortgagereports.com/11306/buy-a-home-with-a-low-downpayment-or-no-downpayment-at-all

Posted by: salzerfrocarephey55.blogspot.com

0 Response to "How Top Buy A House With No Money Down"

Post a Comment